cf68 How do foreign employees participate in compulsory insurance in Vietnam

Đăng ngày:

Online Games cf68

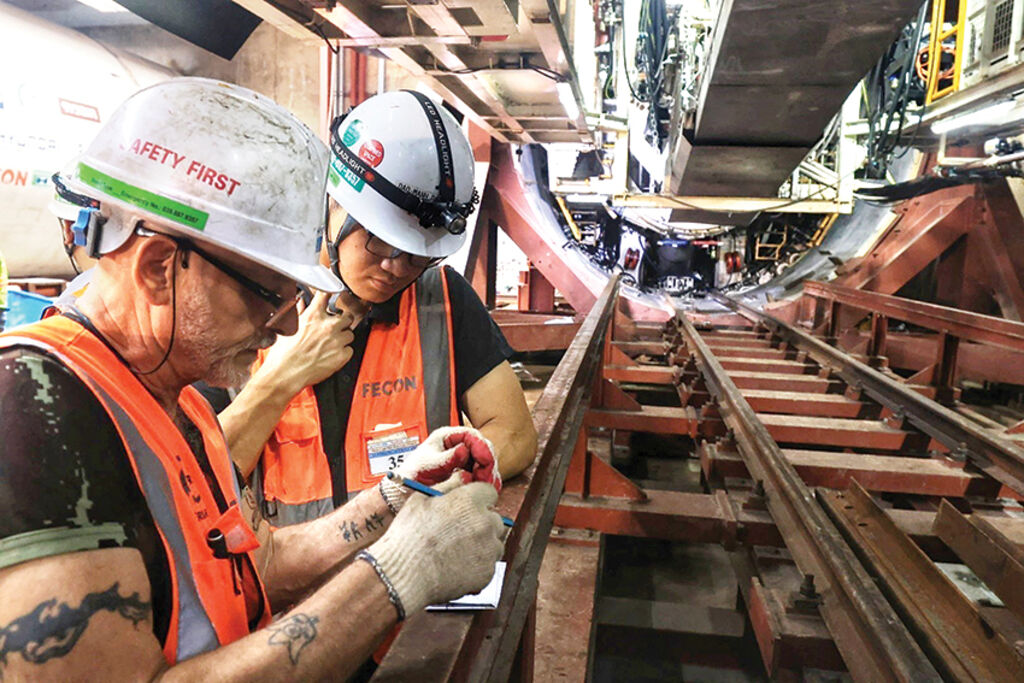

How do foreign employees participate in compulsory insurance in Vietnam? Your browser does not support the audio element. A foreign employee will have to participate in compulsory social insurance and compulsory health insurance if signing a labor contract of a term of full 12 months or longer with a Vietnam-based employer to work in the country. A foreign expert works with an operating staff of the Hanoi’s urban railway line, the Nhon-Hanoi Station route__Photo: Tuan Anh/VNAI’m from the Republic of Korea and going to move to live and work in Vietnam at the end of this year. What kind of compulsory insurance do I have to participate in while working in the country?Under Article 2.2 of the 2024 Law on Social Insurance , which will take effect on July 1 this year, and Article 12.1.c of the Law on Health Insurance , you will have to participate in compulsory social insurance and compulsory health insurance if signing a labor contract of a term of full 12 months or longer with a Vietnam-based employer to work in the country, unless: You are internally transferred within a company in accordance with the law on foreigners working in Vietnam; By the time of entering into the labor contract, you have reached the retirement age. Please note that according to the roadmap to increase the retirement age for employees over the years in Vietnam specified in Article 169.2 of the 2019 Labor Code, the retirement age applied in 2025 is 61 years and three months for men and 56 years and eight months for women; It is otherwise provided by treaties to which the Socialist Republic of Vietnam is a contracting party.What are contribution rates for foreign employees and their employers to compulsory insurance funds?According to current regulations, as from July 1, the compulsory insurance premiums for a foreign employee working in Vietnam will be paid based on the employee’s monthly salary as follows:- To be paid by the employee: 8 percent of the monthly salary to the retirement and survivorship fund and 1.5 percent to the health insurance fund;- To be paid by the employer: 14 percent of the monthly salary to the retirement and survivorship fund, 3 percent to the sickness and maternity fund, and 0.5 percent to the work injury and occupational disease fund as the case may be. Particularly, in case the employer is an enterprise operating in a sector posing a high level of occupational accident and disease risks and meeting several certain conditions, the rate of contribution to the work injury and occupational disease fund will be 0.3 percent rather than the normal rate of 0.5 percent.Hence, the foreign employee’s total contribution to compulsory insurance funds is equal to 9.5 percent of his monthly salary while his employer will make a payment equaling 20.5 percent of the employee’s monthly salary. A foreign couple is shopping at a fair in Vietnam__Photo: VNAHow will the monthly salary serving as a basis for calculation of compulsory social insurance premiums be determined?As specified in Article 31 of the Law, the salary used as a basis for compulsory social insurance premium payment for an employee is his monthly salary, inclusive of the performance or title-based salary, salary-based allowance, and other additions to be paid by the employer to the employee on a regular and stable basis in each salary period according to the agreement between the two parties.For an employee who stops working but still enjoys monthly salary equal to or higher than the salary used as a basis for payment of compulsory social insurance premiums, social insurance premiums will still be paid on the basis of the salary that the employee receives during the layoff period.Noteworthily, the Law also provides a reference level which will be decided by the Government to be used for calculation of premium rates and insurance benefits for a number of social insurance regimes and adjusted on the basis of consumer price index increase rate and economic growth rate and must be conformable to the capacity of the state budget and the social insurance fund.The salary used as a basis for compulsory social insurance premium payment is neither lower than the reference level nor higher than 20 times the reference level applicable at the time of payment of insurance premiums.Please be noted that, in case you do not receive salary for 14 working days or more in a month, your employer will not have to pay social insurance premiums for you in that month, unless you and your employer so agree. In that case, social insurance premiums will be paid based on the salary of the preceding month.However, in case you take leaves under the sickness regime for 14 days or more right in the first month at work or in the first month after returning to work, your employer will still have to pay social insurance premium for you for that month.As far as I know, currently, foreigners working in Vietnam are not subject to compulsory unemployment insurance. However, is it possible for me to voluntarily participate in unemployment insurance? If yes, may I receive unemployment allowance when I terminate my job at my company?As per Articles 2, 3 and 43 of the 2013 Law on Employment, workers who are Vietnamese citizens aged 15 years or older and capable of working and work under an indefinite-term or definite-term labor contract or employment contract or a seasonal labor contract, or perform a certain job with a term of between full three months and under 12 months will be eligible to participate in unemployment insurance. Referring to the above-said provisions, as a foreign employee working in Vietnam, you are ineligible for participation in unemployment insurance and the social insurance agency has no grounds to collect unemployment insurance premiums from you.- obj.style.height = obj.contentWindow.document.documentElement.scrollHeight + 'px'; }、See also、May foreign tourists bring their own vehicles into Vietnam? May overseas Vietnamese open savings accounts in Vietnam? May employers transfer employees to jobs other than those stated in signed contracts? Are tax debtors allowed to leave the country? Identity certificates for people of Vietnamese origin with unknown citizenship under new law What are requirements for foreign architects to practice in Vietnam? How to calculate severance allowances for foreign employees? Are foreign employees entitled to severance allowance? May foreign workers authorize Vietnamese employers to carry out PIT finalization for them? How do foreign workers carry out personal income tax finalization in Vietnam?Monday 03/10/2025 - 10:03

function resizeIframe {